Due to today's market strength, a line in the sand has been broken.

Google broke the $400 mark just now! $400.01 was the peak. This (in my mind) opens the market up to reach new highs.

I have little hope that GOOG will close the day above $400, but the line in the sand has been broken. Who knows what tomorrow will bring? If this strength holds, goog will soon reach $450.

Thursday, April 30, 2009

Tuesday, April 28, 2009

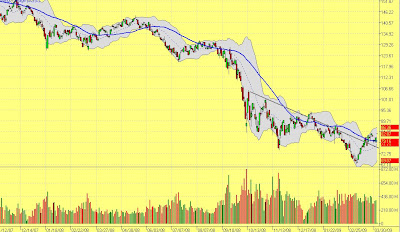

S & P Downtrend

I just finished re-watching a video that suggested the market should pull back, form a higher low and then take off. Funny thing, it was an old video and the market has yet to pull back. We need this pull-back before sidelined money will be drawn in.

Since this was our third lower day in a row, one hopes the process has begun. That said, am I still in FAZ? No! During this morning's gap down, I was at a 10% profit so I sold. Yum!

In review of the day's action, I wish I had re-bought later... I am expecting the market to fall more overnight. Today's trading action was confusing. The TRIN and TRINQ were bearish but the A/D was positive most of the day, I thought it best to just watch the show unfold. Therefore, by not being involved, I missed a great chance.

I'll get better.

Update (the next day): Durn good thing I didn't re-buy FAZ! This morning, the market was very strong.

Since this was our third lower day in a row, one hopes the process has begun. That said, am I still in FAZ? No! During this morning's gap down, I was at a 10% profit so I sold. Yum!

In review of the day's action, I wish I had re-bought later... I am expecting the market to fall more overnight. Today's trading action was confusing. The TRIN and TRINQ were bearish but the A/D was positive most of the day, I thought it best to just watch the show unfold. Therefore, by not being involved, I missed a great chance.

I'll get better.

Update (the next day): Durn good thing I didn't re-buy FAZ! This morning, the market was very strong.

Monday, April 27, 2009

A new trend forming?

Click for a larger image.

Funny thing, now that I've finally convinced myself that we are in a bullish market, the SPY may well be falling out. Yesterday was a lower high and today was even lower.

Not enough evidence to call it a downtrend, since the lows are higher, but, we may be on to something here: the market is definitely less interested in moving up.

If it is the beginnings of a several day downtrend, I can proudly say that I got in on the peak. I am carrying a small position in FAZ overnight. So far so good! At the close of today's trading, the market internals were mixed, but in my favor and my investment is currently up better than 2%.

I am actually looking for an SPY pull-back to about $78 which could take a week or possibly even two. That would make my FAZ trade well worthwhile, and then make the longer-term bull rally more powerful.

OBTW: I really couldn't find any satisfactory fundamentals in the $CYC index (see my post below) so I'll happily return focus to my list of short interest stocks once the bulls take over again.

Sunday, April 26, 2009

Another bullish indication, with cautions

There is a perfect index to watch in times like these; It is designed to be an early indicator of cycle change! It's called the $CYC, and is made up of 30 stocks. The index does show a rising 50 ma therefore many of its components must have a lot of strength in this market.

Click for larger image, browser back to return.

This list of its stock components is here.

Personally, I am not comfortable taking large long positions when the broad market is not uptrending, but some of these do deserve a place in my portfolio. I'll scour the list of 30 to create a short list based on the 50ma, then check the fundamentals of the survivors and weed out a few more. If the analysts are bullish on the remainders, next week I'll buy 1/4 positions in each for a longer term hold.

I guess this means that its time to start getting into the market.

That concept scares me due to the political-economic climate: I just can't understand how our country accepting unprecedented levels of debt, on mostly unproductive spending projects, most to occur in the out-years, with no plans to repay, printing money so we can spend even more, 300% growth of national debt, 400% increase in the size of government, many large projects still not addressed, the nationalism of many private corporations, increased terrorism threats, potential war escalation, increasing unemployment due (in part) to large businesses going bankrupt, 30% of small business owners working for free... ARRRRGGGG!

Why is this bullish? Because the chart says so. Ya gotta trade what you see, not what you expect.

Bonus Information (terror threat confirmation):

Military troops, National Guardsmen, and and Police guarding the Obamma Inauguration: 42,500.

U. S. Troops in Afghanistan: 31,000.

Have fun!

Click for larger image, browser back to return.

This list of its stock components is here.

Personally, I am not comfortable taking large long positions when the broad market is not uptrending, but some of these do deserve a place in my portfolio. I'll scour the list of 30 to create a short list based on the 50ma, then check the fundamentals of the survivors and weed out a few more. If the analysts are bullish on the remainders, next week I'll buy 1/4 positions in each for a longer term hold.

I guess this means that its time to start getting into the market.

That concept scares me due to the political-economic climate: I just can't understand how our country accepting unprecedented levels of debt, on mostly unproductive spending projects, most to occur in the out-years, with no plans to repay, printing money so we can spend even more, 300% growth of national debt, 400% increase in the size of government, many large projects still not addressed, the nationalism of many private corporations, increased terrorism threats, potential war escalation, increasing unemployment due (in part) to large businesses going bankrupt, 30% of small business owners working for free... ARRRRGGGG!

Why is this bullish? Because the chart says so. Ya gotta trade what you see, not what you expect.

Bonus Information (terror threat confirmation):

Military troops, National Guardsmen, and and Police guarding the Obamma Inauguration: 42,500.

U. S. Troops in Afghanistan: 31,000.

Have fun!

Saturday, April 25, 2009

The market seems to have picked a direction!

I have been slacking. I haven't looked thru my fav's for a while.

- SSO/SDS, Leveraged broad market index: Bull rally. Above the flattening 50 ma.

- FAS/FAZ, Financial Sector: FAZ, Choppy. Bull Rally. Above the declining 50 ma.

- ERX/ERY Energy Sector: ERY, Choppy. Forming a pendant. Above the rapidly declining 50 ma.

- TNA/TZA Small Cap Sector: TZA, Bull rally. Above the flattening 50 ma.

- BGU/BGZ Large Cap Sector: BGZ, Bull rally. Above the flattening 50 ma.

When the 50 day moving averages begin turning up, particularly the SSO, I'll be placing longer term positions in my retirement accounts. Will you?

Note to self: watch for the SPY to break (close above) $88, TNA at $29, BGU at $33, and FAS at $12.

- SSO/SDS, Leveraged broad market index: Bull rally. Above the flattening 50 ma.

- FAS/FAZ, Financial Sector: FAZ, Choppy. Bull Rally. Above the declining 50 ma.

- ERX/ERY Energy Sector: ERY, Choppy. Forming a pendant. Above the rapidly declining 50 ma.

- TNA/TZA Small Cap Sector: TZA, Bull rally. Above the flattening 50 ma.

- BGU/BGZ Large Cap Sector: BGZ, Bull rally. Above the flattening 50 ma.

When the 50 day moving averages begin turning up, particularly the SSO, I'll be placing longer term positions in my retirement accounts. Will you?

Note to self: watch for the SPY to break (close above) $88, TNA at $29, BGU at $33, and FAS at $12.

Friday, April 17, 2009

Just saying...

I noticed that FAZ, the Financial Bear fund is getting some intense volume. It is likely that some savvy institutions are expecting a market turn-around in the relatively near future.

Let the Bulls beware!

As always, click for larger image... browser/back to return.

Further confirmation: watch some of D7's recent videos, like this one, to see what is really going on the market.

I noticed that FAZ, the Financial Bear fund is getting some intense volume. It is likely that some savvy institutions are expecting a market turn-around in the relatively near future.

Let the Bulls beware!

As always, click for larger image... browser/back to return.

Further confirmation: watch some of D7's recent videos, like this one, to see what is really going on the market.

Thursday, April 9, 2009

Breaking News

In this article, we find that our government leaders are considering amnesty and citizenship for millions of illegal aliens. If passed, we can logically expect to find more people competing for a limited number of jobs. When the public has reduced employment opportunity, there will be less spending. Reduced spending cuts corporate earnings. Reduced corporate earnings, reduces the value of companies, and thus, stock Price.

In other news, SPY key resistance levels have broken!

Click for larger image.

This is about three weeks of 60 minute Price action. As you can see, The market has been remarkably flat until today. Finally, the trend has broken and the markets are on the way up for a while.

Does everyone know how to find a list of 'short interest' stocks? They are fun to own! Here is a three day chart of one that I bought this morning/sold this afternoon, GCI.

Have fun!

In other news, SPY key resistance levels have broken!

Click for larger image.

This is about three weeks of 60 minute Price action. As you can see, The market has been remarkably flat until today. Finally, the trend has broken and the markets are on the way up for a while.

Does everyone know how to find a list of 'short interest' stocks? They are fun to own! Here is a three day chart of one that I bought this morning/sold this afternoon, GCI.

Have fun!

Tuesday, April 7, 2009

Link forwarding

I wanted to point out this webpage.

They have a chart that says we are almost out of the bear market!

I hope that they are rite, this whipsaw stuff is bad for my nerves. I am not a very good day-trader. (yet) I am anxious to return to the days where you could expect almost every stock to be somewhat higher in a month.

They have a chart that says we are almost out of the bear market!

I hope that they are rite, this whipsaw stuff is bad for my nerves. I am not a very good day-trader. (yet) I am anxious to return to the days where you could expect almost every stock to be somewhat higher in a month.

Monday, April 6, 2009

This weekend overview video at FreeTradingVideos.com Points out some major volume action that I missed in my chart analysis. My friend, D7, indicates that it was likely that a bottom has formed. He agrees that a pullback should happen soon, and then its off to the races!

Sunday, April 5, 2009

Trade what you see

Don't risk your money based on my words, any other pro trader, or news commentator recommendations or expectations. (But do stay tuned in -- you can learn stuff.) It is not possible to make a profit on a stock, no matter how highly recommended, if Price goes down (unless you are shorting).

My attitude has been very bearish due to recent political actions but the market has made some truly wonderful returns for those who are well positioned (some of my investments!) That said, be very cautious about long term trades. Even holding a stock overnight can be very risky for numerous reasons. The broad market has been choppy and is down from even late last year and we are due for a pullback, just to name two.

I have made personal improvements in being able to trade what the chart data is saying, therefore, I am allowing myself to return to my favorite sites (i.e. FreeTradingVideos.com) and learn from my superiors. Monday morning, no matter what anyone says, I will be trading the message that the charts are sending, not anyone's recommendations.

The NASDAQ (QQQQ) is making a yearly high and a higher high. That's a Catch 22 situation... Tech stocks are taking off again so semiconductors (SMH) are prospering. Since chip makers are running, the NASDAQ is improving. Now, since the NASDAQ is a leading indicator, the broad market is trying to follow. We win! I suspect that once the Q's puts in a higher low, there will be a flood of sidelined capitol being re-invested. Get ready!

Oops, there I go... don't take my word for it. Keep an eye on the charted data for proof.

My attitude has been very bearish due to recent political actions but the market has made some truly wonderful returns for those who are well positioned (some of my investments!) That said, be very cautious about long term trades. Even holding a stock overnight can be very risky for numerous reasons. The broad market has been choppy and is down from even late last year and we are due for a pullback, just to name two.

I have made personal improvements in being able to trade what the chart data is saying, therefore, I am allowing myself to return to my favorite sites (i.e. FreeTradingVideos.com) and learn from my superiors. Monday morning, no matter what anyone says, I will be trading the message that the charts are sending, not anyone's recommendations.

The NASDAQ (QQQQ) is making a yearly high and a higher high. That's a Catch 22 situation... Tech stocks are taking off again so semiconductors (SMH) are prospering. Since chip makers are running, the NASDAQ is improving. Now, since the NASDAQ is a leading indicator, the broad market is trying to follow. We win! I suspect that once the Q's puts in a higher low, there will be a flood of sidelined capitol being re-invested. Get ready!

Oops, there I go... don't take my word for it. Keep an eye on the charted data for proof.

Thursday, April 2, 2009

OMG! I need more MA's!

I have been trying to keep my charts as clean as possible, however, I just noticed that one of my "short interest" stocks (MW) has recovered so much that after battling and beating the 50 day Moving Average (MA), it has taken out the 200!

Click for a larger image.

While no one would call the markets "healed", not even Cramer. One must admit that the markets do have a lot of strength. In fact, today Jim said that we are out of the depression, its now just a recession.

Click for a larger image.

The Gann Angles on this six week, hourly, chart of DIA (the Dow 30) show that momentum is slowing, however, there is no reason to think the rally is over (after the gap gets filled).

Please do be careful. Use protective stops. Invest wisely. Buckle your seat belts, its going to be a bumpy ride.

The daily DIA chart is still in an official downtrend... lower highs and lower lows. Both the 50 and 200 MA's are still in a downtrend as well. Watch for a close above $90 before we can go long with a fair amount of certainty and looser stops.

Click for a larger image.

While no one would call the markets "healed", not even Cramer. One must admit that the markets do have a lot of strength. In fact, today Jim said that we are out of the depression, its now just a recession.

Click for a larger image.

The Gann Angles on this six week, hourly, chart of DIA (the Dow 30) show that momentum is slowing, however, there is no reason to think the rally is over (after the gap gets filled).

Please do be careful. Use protective stops. Invest wisely. Buckle your seat belts, its going to be a bumpy ride.

The daily DIA chart is still in an official downtrend... lower highs and lower lows. Both the 50 and 200 MA's are still in a downtrend as well. Watch for a close above $90 before we can go long with a fair amount of certainty and looser stops.

Bounce!

This AM caught me by surprise... SPY is bouncing off of its 50 ma.

While this is of course bullish, it would have been healthier for the markets if the pullback was deeper.

Anyway, I am enjoying it... I have several small positions with huge short interest... eg: TSL, CAB, MTN, and others. I buy them on dips and sell on the rips like today... Its a brainless way to pick up a few percentage points.

I was listening to Rush Limbaugh a few days ago and made some $$$ from his wisdom...

Since Obummer is the new CEO of GM and Chrysler (facism), he has the authority to take over the job of directing business. Since Obummer does not like trucks and SUV's (the only profitable products) the car manufacturers will be directed to build smaller, more fuel efficient vehicles. Americans only buys these when gasoline is terribly expensive. Since he is also the CEO of the oil industry, all he has to do is raise the cost of a tank of gas to make his little cars sell.

To that end, he has already begun making millions of acres of drillable oilfields off limits.

It's another no-brainer trade, I bought UGA, the gasoline ETF. It popped up 6% this AM!

I think I'll hold for a while longer.

Have fun!

Subscribe to:

Posts (Atom)